Debt to Asset ratio or Debt/Asset ratio is one of the basic financial analysis ratios used by businesses around the world. This simple ratio gives, both the business as well as potential investors, valuable and quick information on the solvency of the company.

How to Measure Debt to Asset Ratio? (Formula)

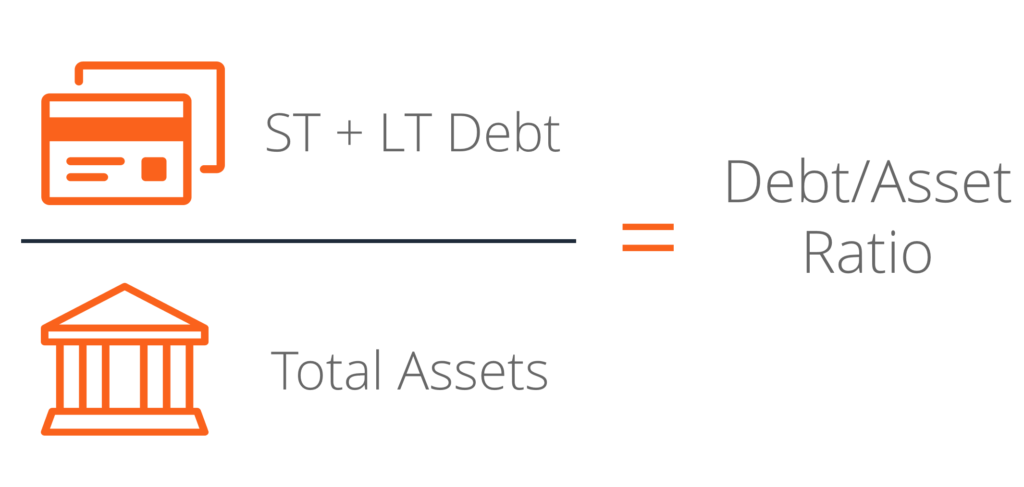

The formula is in the name of the ratio itself. So, remembering the formula for students is quite easy. Debt to Asset ratio is measured by dividing the total of debt obligations of the company by its asset base.

Debt to Asset Ratio = Total Debt / Total Assets

Debt to Asset Ratio = (Short Term Debt + Long Term Debt) / (Current Assets + Fixed Assets)

What Does Debt to Asset Ratio Mean?

The resulting value of this ratio gives an indication of how much of total debt obligations or liabilities are covered by its assets.

The value can range from 0 to 1, and usually the higher the number is considered to be worse.

For an example; if a company has a Debt to Asset ratio of 0.7, it means that 70% of the company's assets will have to be sold to cover up the debt obligations in case of company closure. This naturally is a much worse situation as there will be less asset value for the owners of the company.

A high Debt to Asset ratio signifies a high leverage of the company's assets. Higher leverage usually hints a higher risk for the company as more assets are under risk of being restricted to resolve company debts.

Hence, a lower Debt to Asset ratio (usually less than 0.5) is considered to be favorable for a company.

No comments:

Post a Comment