|

| Image: corporatefinanceinstitute.com |

Debt/Equity Ratio or Debt to Equity Ratio or D/E Ratio is a popular financial ratio used by many businesses around the world. Both business and investors benefit from this formula for quick and easy decision making.

What is Debt to Equity Ratio?

Debt to Equity ratio measures the total debt or the liabilities of the company as a portion of the company's equity. This gives an indication of the capital structure of the company; owner's funds vs debt funds.

Equity is the owner's or shareholder's interest in the company, and debts are what is owed by the company to outsiders.

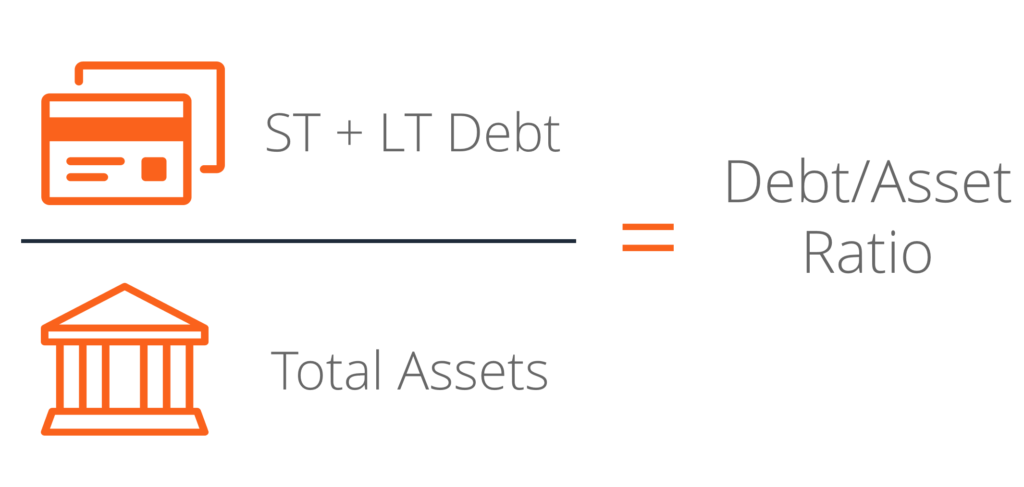

Debt to Equity Ratio = Total Debt / Total Equity

Debt to Equity Ratio = (Total Short Term Debt + Total Long Term Debt) / Shareholder Equity

What Does Debt to Equity Ratio Mean?

The result of the Debt to Equity ratio gives an indication of the risk undertaken by the company in financing its assets.

A higher D/E ratio signals that the outsiders (lenders, creditors etc) have a higher claim on the company's assets. On the flip side, it also suggests that the owners of the business (entrepreneur, shareholders etc) have less claim on the company's assets thus less control even.

A higher D/E ratio also means that any further potential borrowing money for the company will be very difficult. Even if they do secure loans, it will be at a higher cost than usual. Nobody wants to restrict their cash in a company where owners have less control/interest/ownership of the company.

One possibly plus point for a high Debt to Equity ratio is that it shows that the owners were able to retain the control of the company with a limited investment. However, this does not look so good for outsiders.

Hence, naturally a lower D/E ratio is preferred for a company with regards to the risk it undertakes.